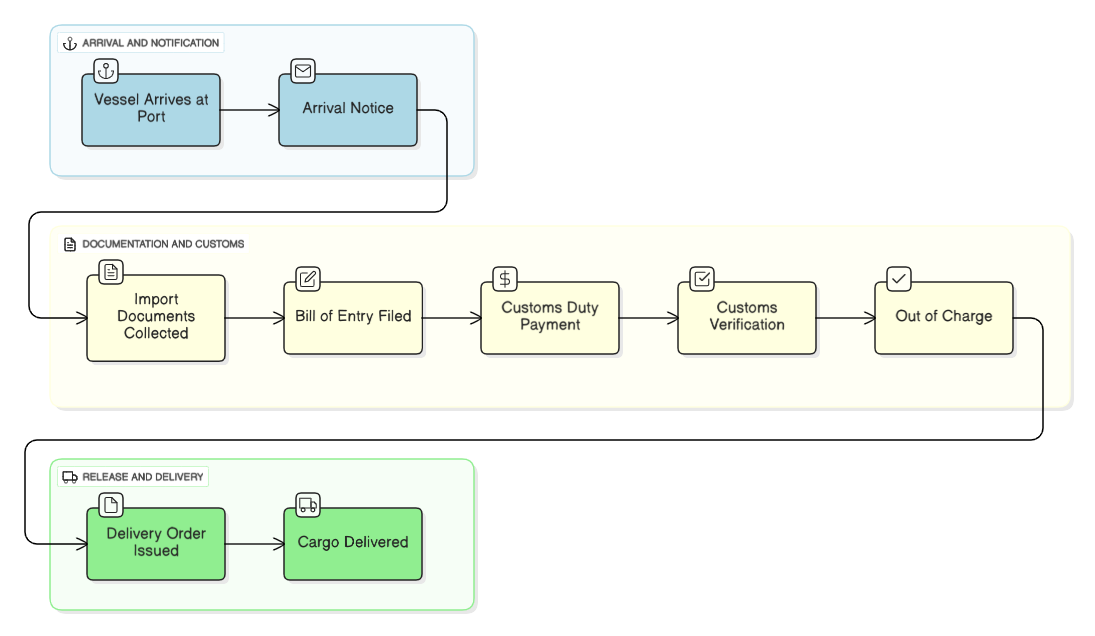

Importing goods involves customs clearance, documentation, coordination with shipping lines, and final delivery planning. For first-time importers, understanding the sequence of steps makes the process far more manageable.

This blog explains the complete import process, from the time the ship arrives at the destination port until the goods are delivered to the importer’s location, in clear and simple language.

Step 1: Vessel Arrives at Destination Port

The import process begins when the vessel carrying the cargo reaches the destination country’s port.

Once the ship arrives:

- Containers are discharged at the port terminal

- The shipping line or its local agent issues an Arrival Notice to the importer or their customs agent

The arrival notice informs the importer that the shipment has reached the destination and import formalities can now begin.

- [Sample Arrival Notice – Download]

Step 2: Import Documents Are Collected

Before customs clearance can start, the importer or their customs broker gathers all required documents. These typically include:

- Bill of Lading (BL)

- Commercial Invoice

- Packing List

- Certificate of Origin (COO), if applicable

- Insurance documents, if applicable

These documents are essential for declaring the cargo to customs and determining duties and taxes.

- [Sample Bill of Lading – Download]

- [Sample Commercial Invoice – Download]

- [Sample Packing List – Download]

- [Sample Certificate of Origin – Download]

Step 3: Bill of Entry Is Filed with Customs

A Bill of Entry is filed electronically on the customs portal by the importer’s customs broker.

The Bill of Entry includes:

- Description and classification of goods

- Declared value

- Country of origin

- Applicable customs duty and taxes

Customs uses this filing to assess the shipment and calculate duties payable.

- [Sample Bill of Entry – Download]

Step 4: Customs Duty Payment

Once the Bill of Entry is filed, customs calculates the import duty and taxes, if applicable.

The importer must pay the assessed duty before the cargo can be released. Payment is usually done electronically through authorized banking channels.

If duties are not paid, cargo will not be released even if documents are correct.

Step 5: Customs Examination and Inspection

After duty payment, customs may:

- Clear the shipment based only on documents, or

- Select the shipment for physical examination

If selected for examination:

- The container is moved to a CFS or examination area

- Customs officers verify the cargo against the declared documents

- If required, samples may be taken

Once examination is completed successfully, customs proceeds with clearance.

Step 6: Out of Charge (OOC) Is Issued

After customs is satisfied with the documents, examination, and duty payment, they issue Out of Charge (OOC).

OOC means customs has officially released the goods from customs control.

Without OOC, goods cannot be taken out of the port or CFS.

- [Sample Out of Charge (OOC) – Download]

Step 7: Delivery Order Is Issued by Shipping Line

Once customs clearance is completed:

- The importer or agent approaches the shipping line

- Port charges and shipping line charges are settled

- The shipping line issues a Delivery Order (DO)

The Delivery Order authorizes the terminal to release the container or cargo to the importer.

- [Sample Delivery Order – Download]

Step 8: Cargo Is Collected and Delivered

After receiving the Delivery Order:

- The container or cargo is released from the port or CFS

- Transportation is arranged to move goods to the importer’s warehouse or final delivery location

At this stage, the import process is fully completed.

How to Know Where You Are in the Import Process

- Arrival notice received → Import process has started

- Documents collected → Ready for customs filing

- Bill of Entry filed → Under customs assessment

- Duty paid → Awaiting clearance or examination

- OOC issued → Customs clearance completed

- Delivery Order issued → Cargo ready for pickup

Common Issues Faced During Import

- Missing or incorrect documents

- Mismatch between invoice and cargo

- Delay in duty payment

- Customs examination delays

- Late coordination with shipping line

Early planning and working with an experienced logistics partner helps avoid these issues.

Final Note for Importers

Understanding the import process allows businesses to plan timelines, manage costs, and avoid unnecessary delays. While customs procedures are mandatory, having clear visibility of each step makes the process smooth and predictable.

A reliable freight forwarder and customs broker can guide importers through every stage, from arrival to final delivery.